Definest is a research-first toolkit for copy-curious traders. It helps you:

1. discover wallets on DEXs with 58+ filters,

2. analyze behavior over multiple windows from 12h to 2y,

3. check how copyable those results might be for you,

4. backtest your rules before risking funds,

5. and, if you want, automate with guardrails.

It is built for people who like a process over a guess. No magic buttons here.

Why PnL alone can fool you

On-chain stats can look shiny and still be hard to replicate. Liquidity can be thin, slippage and taxes add up, MEV can sting, and timing matters more than we like to admit. A wallet might show a big Total PnL because it is sitting on Unrealized gains or because one monster trade carried the whole track. A better approach looks like this:

• screen first to cut obvious bad fits,

• check stability across several timeframes,

• ask if you could have copied those moves under your constraints,

• backtest your rules,

• then automate slowly and defensively.

That is the route we will take here.

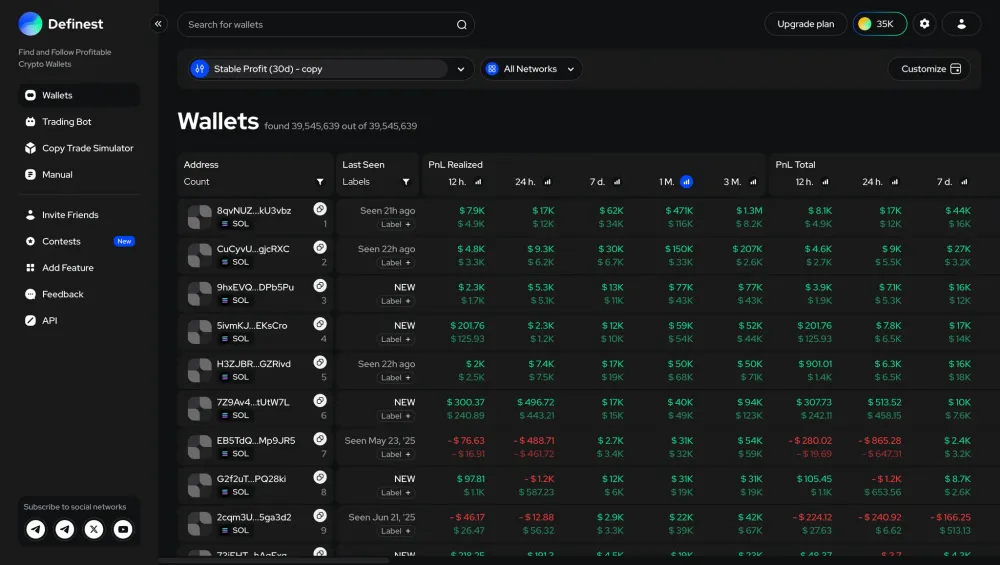

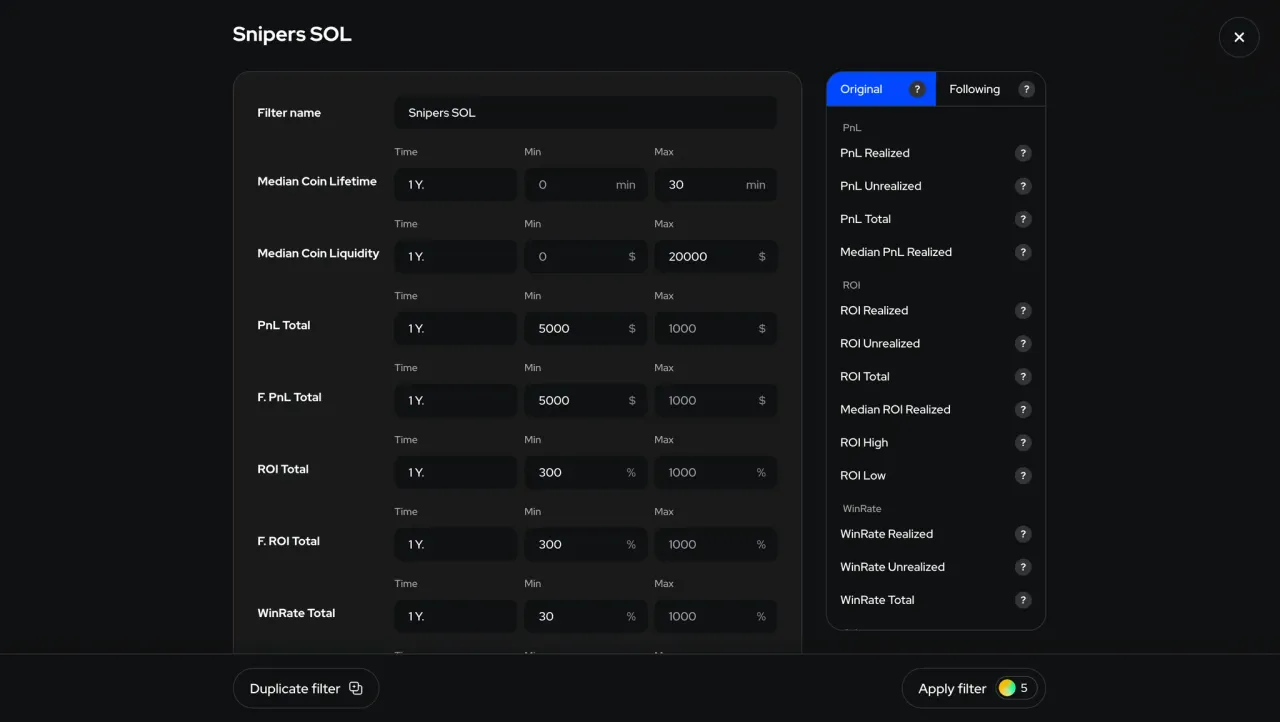

Wallet Finder - 58+ filters that actually matter

You do not need all the filters at once. Pick the ones that match your thesis, then add or remove as you learn. The core buckets look like this:

• Returns and shape: PnL and ROI in Realized, Unrealized, and Total views, plus Median ROI Realized, ROI High and ROI Low, Top Deal Percentage, and a Regression Score that hints at how “linear” the equity curve has been.

• Hit rate and activity: WinRate in the same splits, Total Trades and Closed Trades, and tempo info like median deal time and when trades typically start.

• Risk: Max Drawdown and Sharpe Ratio (sometimes labeled “Sharp Rate”).

• Token quality and liquidity: Median Coin Liquidity and Median Coin Lifetime, plus flags for Scam Trades.

• Sizing: Investment Amount, Median First Buy Amount, and Median Buy Amount.

A sensible screen might read like this: positive Realized ROI, moderate drawdowns, a reasonable WinRate, no heavy dependence on one lucky spike, and a minimum baseline for token liquidity and lifetime. You are not hunting perfection. You are excluding patterns you do not want.

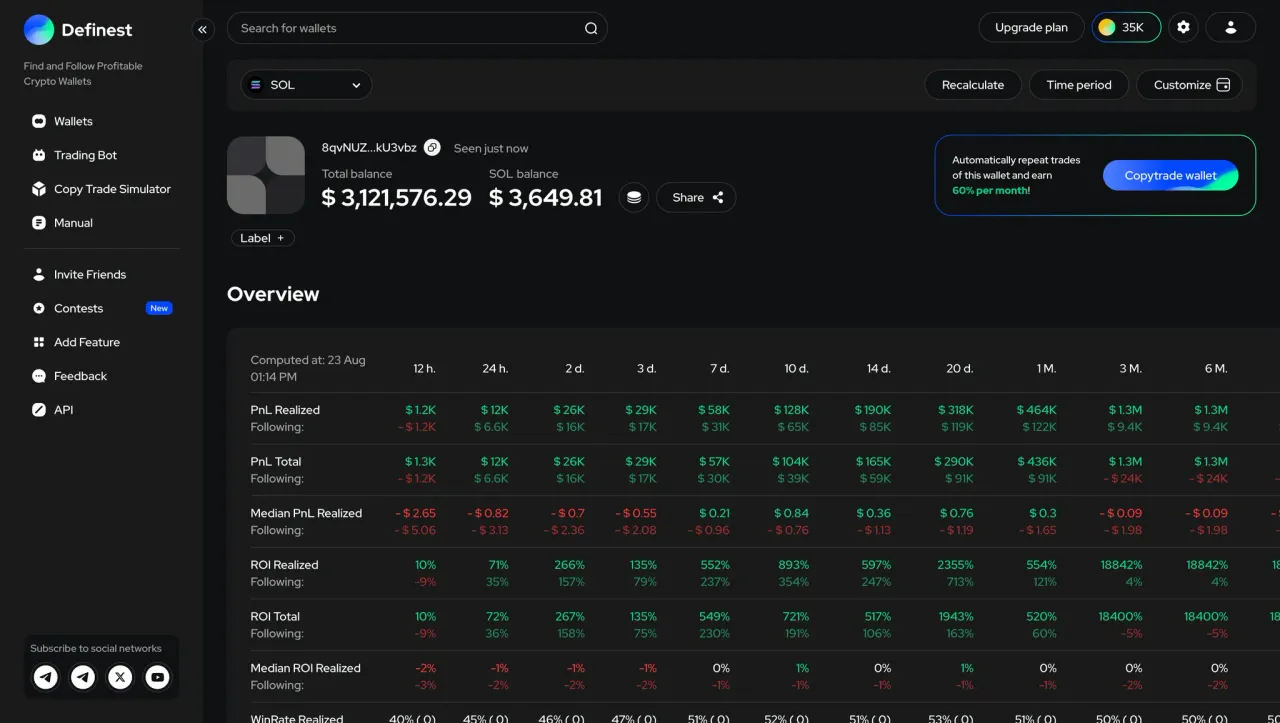

Wallet Analyzer - time windows from 12h to 2y

Shortlists are great, but context is everything. The Analyzer shows the same metrics across windows like 12h, 24h, 2d, 3d, 7d, 10d, 14d, 20d, 1m, 2m, 3m, 6m, 1y, and 2y. What you are looking for:

• Convergence vs fragility. Do PnL, ROI, and WinRate live in a reasonable band across windows, or does the story fall apart outside the last month.

• Drawdown reality. Big Unrealized with weak Realized often hides rough patches you would have hated living through.

• Concentration. Rising Top Deal Percentage means a few trades did the heavy lifting.

• Token context. If Median Liquidity or Lifetime collapses on longer windows, the wallet may be surfing short-lived narratives.

Think of this as a regime check. If the edge only shows up in one hot slice of time, assume it can vanish the same way it appeared.

Followability Scores - would copying you have actually worked

A wallet’s chart is not your chart. Followability replays the wallet’s buys and sells and then applies your rules: position sizing, token caps, slippage assumptions, and so on. The result is a hypothetical track for you, with PnL, ROI, and drawdowns attached.

No model is perfect, but this beats pretending you would have matched the source wallet 1:1. It also forces you to think through practical constraints before you get attached to a curve.

Copy-Trading Simulator - backtest your logic

Before you risk funds, pressure-test the rules. The simulator is where you find out if your plan only works on one cherry-picked sample or if it survives a few different market moods.

• Sizing controls: percent, fixed, or notional sizing with min and max per trade, duplicate buys with caps, and token-level caps.

• Execution guards: slippage limits, DEX allowlists, liquidity and token-lifetime checks, and automatic retry on fail.

• Exit logic: classic SL and TP, trailing combinations, partial take-profit ladders, time-based closes, and conditional stops like “activate SL after N buys” or cool-downs that block re-entries after a stop.

You get return and risk metrics plus equity curves for A/B testing presets. The goal is not to overfit. The goal is to avoid rules that only work in one perfect backtest.

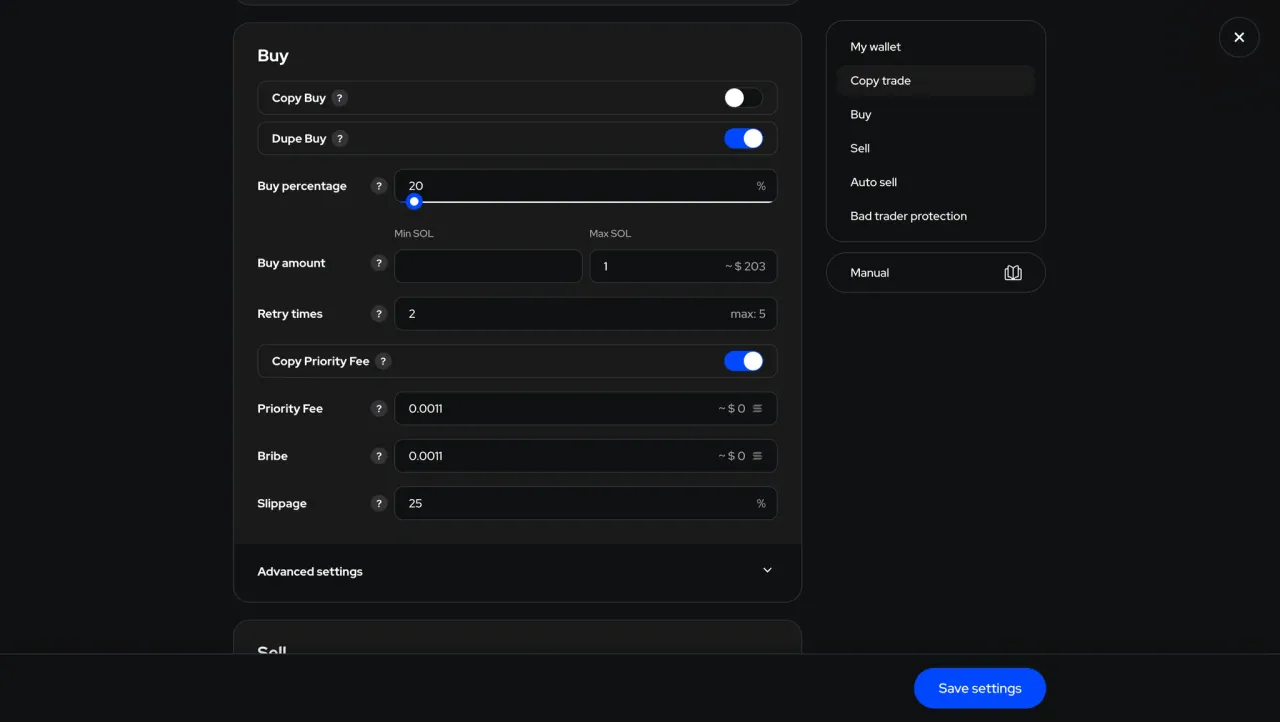

Copy Trading Bot - if you decide to automate

If the sim looks sane, you can mirror the same logic in a live bot. The idea is consistency: what you tested is what you run, with extra safety rails.

• Per-bot rules and sizing: percent or fixed or notional sizing, min and max per trade, duplicate buys with caps, token caps.

• Execution: slippage controls, allowed DEX lists, liquidity and lifetime guards, tax checks, retry on fail, and in many setups Anti-MEV and priority-fee controls.

• Exits: SL and TP, trailing and partials, time-based closes, conditional stops.

• Safety: Bad Trader Protection can auto-pause buys and sells or flatten a position if thresholds on PnL, ROI, or WinRate are hit, or if a loss streak kicks in.

• Multi-wallet and multi-bot: spin up several bots on the same source wallet with different rules, or follow multiple source wallets at once and track them separately or as strategy groups.

Start with tiny size. Treat the first weeks like a pilot. Tighten rules first, scale later.

A quick 5-step workflow you can copy and tweak

1. Write a one-liner hypothesis.

Example: “I want wallets with positive Realized ROI over 30 to 90 days, moderate drawdowns, not carried by one trade, and trading tokens with minimum liquidity and lifetime.”

2. Screen with the Finder.

Realized ROI and PnL above zero, WinRate (Realized) above your bar, Max Drawdown under your threshold, Top Deal Percentage capped, liquidity and lifetime floors, and very few Scam Trades.

3. Stress-test in the Analyzer.

Check 12h to 2y. If the strength only exists in one short window, move on.

4. Run Followability and the Simulator.

Use your real sizing and slippage. Start strict on exits, like firm SL and laddered TP. Compare a couple of presets and keep the one that still looks sane outside your favorite window.

5. Pilot a small bot.

Turn on Bad Trader Protection, limit token exposure, and review behavior after a few different market days. Only consider scaling when the live track resembles your sim, variance and all.

Risk checklist before you flip the switch

• Realized vs Unrealized: if Realized lags far behind Unrealized, those gains are paper until they are not.

• Drawdown tolerance: be honest about the worst peak-to-trough you can emotionally handle. There is no prize for lying to yourself.

• Concentration: a high Top Deal Percentage means outliers did the work. That is hard to repeat.

• Liquidity and lifetime: if your planned size is big relative to Median Liquidity, your fills will be worse than the wallet you are copying.

• Model mismatch: Followability and sim assumptions are not live fills. Expect variance and slip-ups.

• Regime shifts: what worked in a memecoin sprint can stall in chop or reverse in a downtrend.

• Operational risk: smart contract bugs, tax tokens, and parameter changes happen. Diversify and set limits.

Common mistakes worth dodging

• Falling in love with one hot window. If only the 30-day chart looks great, treat that as a yellow flag, not a green light.

• Ignoring execution costs. Slippage, gas, and priority fees can turn a slim edge into a red PnL.

• Overfitting your sim. If the preset only wins on one token cohort and fails on neighbors, it is brittle.

• Sizing too fast. Scale only when live behavior rhymes with the backtest.

Day-to-day habits that help

• Save screens and set alerts. Keep your Finder presets and let alerts do the watching so you are not glued to a dashboard.

• Keep a bench. Maintain a small list of candidate wallets you rotate into or out of after periodic checks.

• Group by thesis. Maybe a “Short-hold Snipers” group and a “30 to 90 day Stable Profit” group. Review PnL and drawdowns at the group level too.

• Write down your rules. If you cannot explain your copy logic in five bullets, you probably will not follow it when things get noisy.

Bottom line

Definest does not promise profits. What it offers is structure. You screen with data, verify across time, see whether those results looked copyable for you, rehearse the rules in a sim, then maybe automate with strict stops. Treat it like a research and risk-management stack, not a shortcut, and you will make faster, clearer calls about whom to follow and when to stand down.